Overview

- September protocol revenue reached about $600 million, nearly double March’s $340 million low, according to The Block Research.

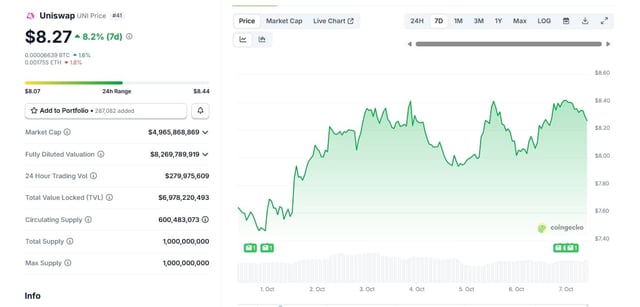

- Uniswap governance approved $165 million in new funding this year and laid groundwork for a v4 fee switch that would route a portion of trading fees to UNI holders via Unichain.

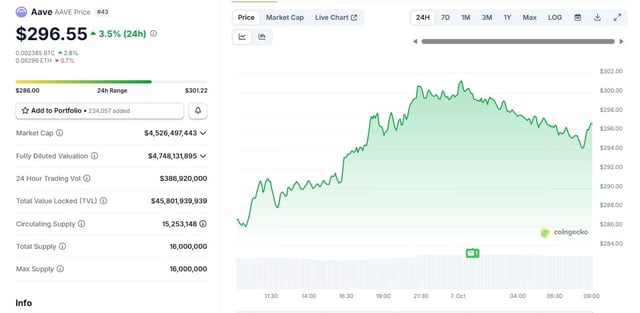

- Aave activated a standing framework that channels surplus revenue into regular AAVE buybacks and its ecosystem reserve, replacing ad hoc treasury moves.

- Ethena converts fees from its USDe and sUSDe stablecoin system directly into holder yield and has climbed revenue rankings with integrations through Aave and Pendle.

- UNI, AAVE and ENA have tracked broader market performance so far, and analysts caution that distributions could ebb if trading volumes rotate or treasuries reprioritize.