Overview

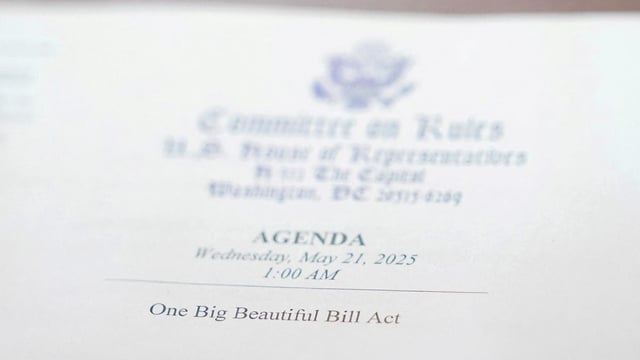

- The House version would raise the deduction cap to $40,000 for households earning up to $500,000 under the One Big Beautiful Bill Act.

- Senate Republicans have upheld the existing $10,000 limit in their reconciliation framework, matching current law to rein in costs.

- SALT Caucus leaders have vowed to block any bill with a $10,000 cap and refuse further changes to their $40,000-for-$500,000 deal.

- White House chief of staff Susie Wiles told Senate Republicans the president expects the package on his desk by July 4, underscoring mounting pressure.

- Fiscal conservatives warn that a higher cap could add up to $600 billion to the deficit over the next decade and unfairly subsidize blue states, a claim rejected by GOP lawmakers from New York and California.