Overview

- Total borrower equity slipped by $141.5 billion year over year to roughly $17.5 trillion, the first broad pullback since the pandemic run-up.

- Homes with negative equity rose 18% to about 1.15 million, lifting the share of underwater mortgages to 2% from 1.7% a year earlier.

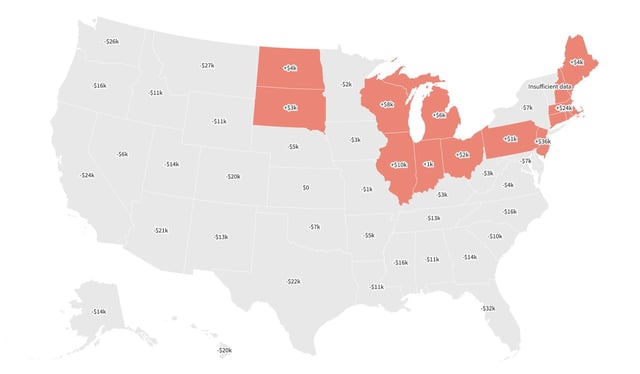

- Equity fell in 32 states and increased in 14, with Vermont excluded from the analysis due to insufficient data.

- The steepest per-home declines were in Washington, D.C. (−$34,400), Florida (−$32,100) and Montana (−$26,900), while gains led in Connecticut (+$37,400), New Jersey (+$36,200) and Rhode Island (+$31,200).

- Economists and agents describe a long-term correction driven by slower price appreciation and higher borrowing costs, with equity changes likely to hinge more on seasonal swings.