Overview

- CoreWeave’s shares have climbed more than 300 percent above their $40 IPO price, making them one of the top performers on Wall Street in 2025.

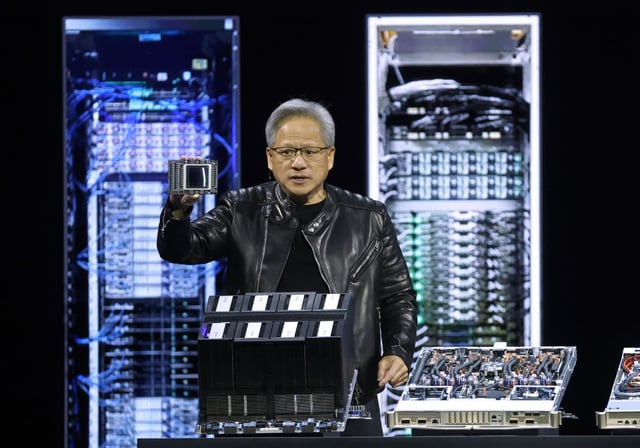

- The company became one of the first AI infrastructure providers to offer Nvidia’s liquid-cooled Blackwell GB300 servers, triggering an almost 9 percent rally around the July 4 weekend.

- In Q1, CoreWeave reported $981.6 million in sales versus $852.9 million expected, and it now holds a $25.9 billion revenue backlog supporting a full-year outlook near $5 billion.

- Strategic partnerships underpin growth: Nvidia owns roughly 5 percent of the company and supplies GPUs first, while a $11.9 billion OpenAI deal and a role in Google Cloud’s compute push secure long-term demand.

- Despite rapid expansion, the business remains unprofitable and trades at a price-to-sales ratio near 27, fueling high short interest and profit-taking advice from Jim Cramer.