Overview

- Section 899 was set to impose punitive levies on foreign investors from jurisdictions deemed to discriminate against U.S. companies.

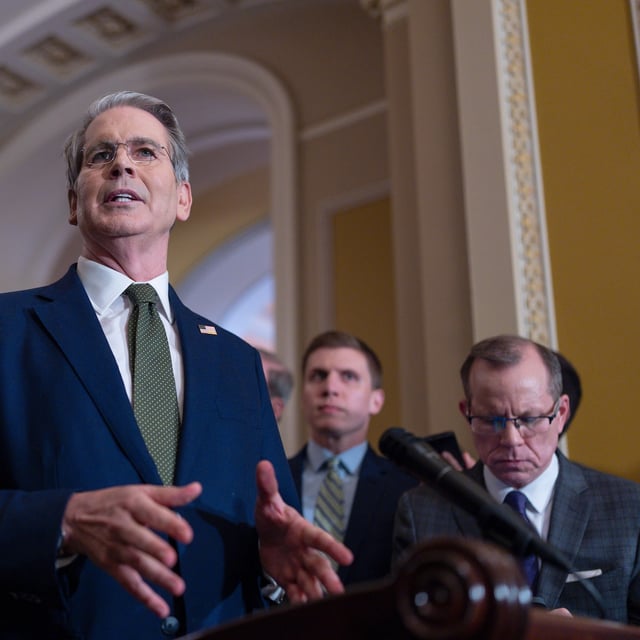

- Senate Finance Chairman Mike Crapo and House Ways and Means Chairman Jason Smith agreed to drop the provision at Bessent’s request and vowed to reinstate it if G7 partners delay implementation.

- A Global Business Alliance analysis warned the levy could cost 360,000 U.S. jobs and reduce GDP by $55 billion annually over the next decade.

- The G7 understanding allows the U.S. to abandon OECD Pillar 2’s 15 percent global minimum tax commitment and preserves U.S. tax sovereignty.

- Australian superannuation funds and other international investors praised the decision as protection from potential multi-billion-dollar retaliatory charges.