Overview

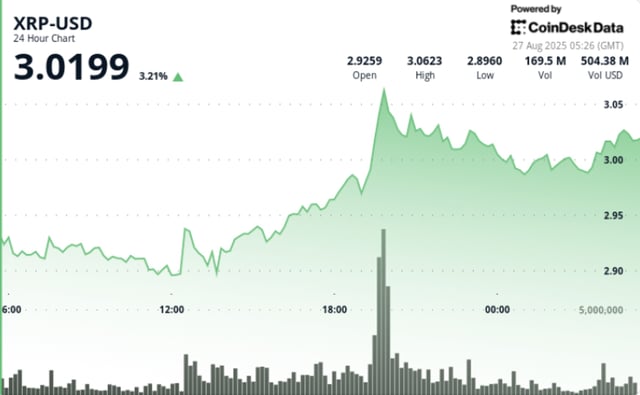

- CME reported its crypto futures complex surpassed $30 billion in notional open interest, with SOL and XRP each crossing $1 billion and XRP the fastest contract in venue history to reach that mark.

- XRP futures logged a peak session on August 25 with 7,533 contracts traded and more than $1 billion in volume, according to CME data.

- CME launched XRP futures on May 19 in standard 50,000‑token and micro 2,500‑token cash‑settled contracts tied to the CME CF XRP‑Dollar Reference Rate.

- Multiple issuers, including Grayscale, Franklin Templeton, Bitwise, WisdomTree, 21Shares and CoinShares, have spot XRP ETF filings under SEC review with extended deadlines clustered in October 2025.

- ETF watchers note more than $800 million is already in futures‑based XRP ETFs, while Bloomberg analysts James Seyffart and Eric Balchunas put high odds on at least one spot approval this year, pending SEC decisions.