Overview

- Clarksons' share price fell nearly 19%, reaching its lowest level since November, following warnings of market uncertainty in 2025.

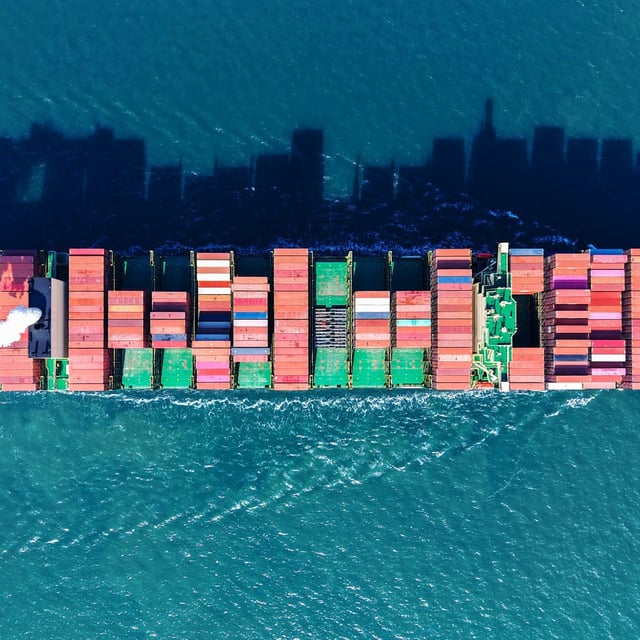

- Geopolitical disruptions, including conflicts in Ukraine, Gaza, and the Red Sea, have strained global supply chains and impacted shipping rates.

- New U.S. tariffs introduced by President Trump, targeting key trade partners like China, Canada, and Mexico, have further destabilized the shipping market.

- Despite challenges, Clarksons reported record underlying profits of £115.3 million in 2024, marking its third consecutive year above £100 million in profits.

- The company raised its dividend for the 22nd consecutive year, but cautioned that continued geopolitical and economic uncertainty could influence its future performance.