Overview

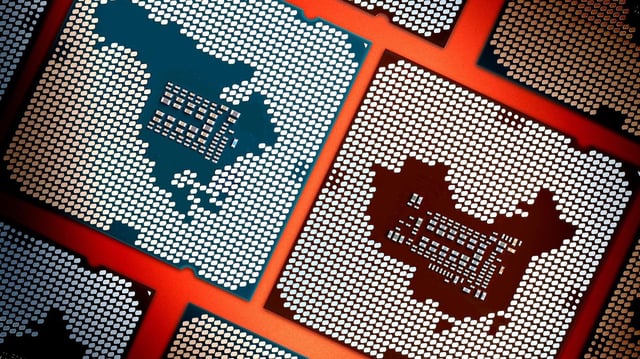

- Since April 4, Beijing has required export licences for seven rare earth elements and related magnets, with approval times stretching beyond two months

- Major automakers including Tesla, General Motors, Maruti Suzuki and Bajaj Auto warn stalled licences could halt production of electric motor magnets, steering systems and transmissions

- Delegations from the United States, India, Japan and European Union states are seeking urgent talks with Chinese officials to expedite pending export applications

- Under a mid-May temporary US-China tariff deal, China agreed to lift non-tariff curbs but US trade representatives accuse Beijing of slow-rolling licence removals

- Governments and companies are accelerating investments in alternative mines and domestic refining capacity to reduce reliance on China’s dominant rare earth production and processing