Overview

- Central Huijin Investment, part of China's sovereign wealth fund, has purchased ETFs to support market stability amid significant sell-offs.

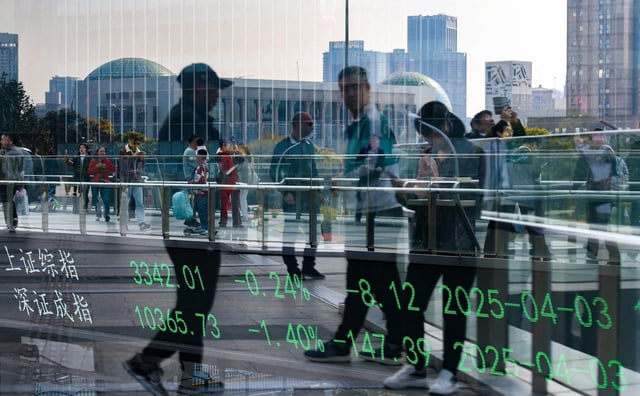

- The intervention follows a 7% drop in the Shanghai Composite Index, its worst single-day performance in five years.

- The downturn was triggered by heightened trade tensions, with the US imposing new tariffs on China and reciprocal measures enacted by Beijing.

- Central Huijin has signaled its confidence in the long-term value of China's capital markets despite ongoing volatility.

- This marks the first major state-led market intervention in over a year, reflecting a continued strategy to mitigate economic instability.