Overview

- The national magnet tracking system, effective last week, compels rare earth magnet producers to report trading volumes and client information online.

- Provincial authorities in Guangxi, Guizhou, Hunan and Guangdong have stepped up inspections of strategic mineral exporters and illegal mines under Beijing’s “whole-chain” export directive.

- Delays in licence processing and halted shipments have alarmed automakers, semiconductor firms and EV manufacturers in the U.S., Europe, India and Japan, prompting warnings of potential production stoppages.

- Industry and diplomatic delegations from India, Japan and Europe are seeking urgent meetings with Chinese officials to expedite export licences and discuss alternative sources.

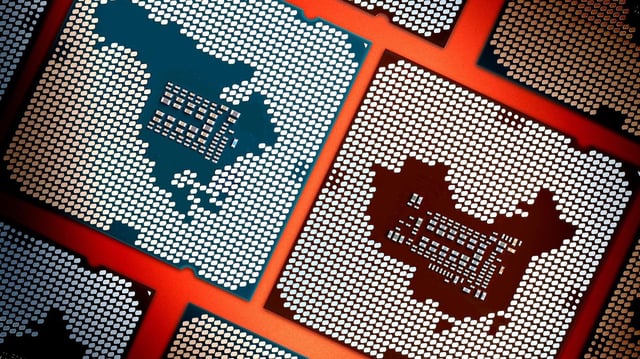

- With China accounting for roughly 60–70% of global rare earth mining and 90% of refining, governments and companies are accelerating efforts to diversify supply chains and reduce dependence on Beijing.