Overview

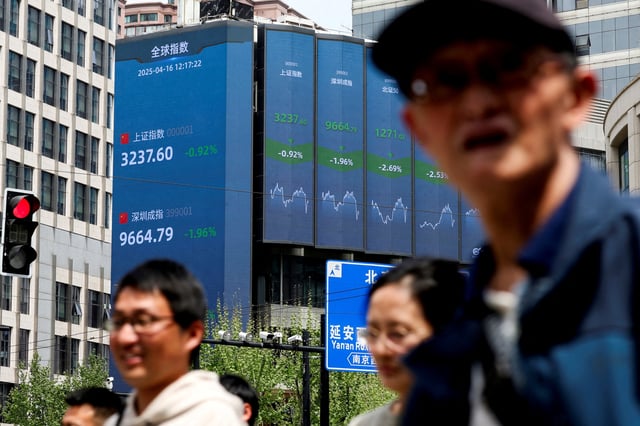

- Shanghai Composite is up about 25% since April and sits at a 10-year high, with the CSI 300 near recent peaks despite weak economic data.

- Analysts say sovereign funds, insurers and other large investors are powering the advance, with daily turnover topping 2 trillion yuan for a record 11 straight sessions.

- Outstanding margin financing has climbed to roughly 2.1–2.18 trillion yuan, the highest since 2015, yet margin trading remains about 2.2% of free-float market value, roughly half 2015 levels.

- Retail participation is rising but measured, with 1.9 million new accounts in July and signs of cash shifting as household deposits fell by 1.1 trillion yuan and non-bank deposits grew by 2.1 trillion yuan.

- Households hold about 160 trillion yuan in savings and face sub-1% deposit rates versus an estimated 2.5% dividend yield on blue chips, prompting estimates of 1.84–2.1 trillion yuan in potential retail inflows as policymakers weigh bubble risks against growth support.