Overview

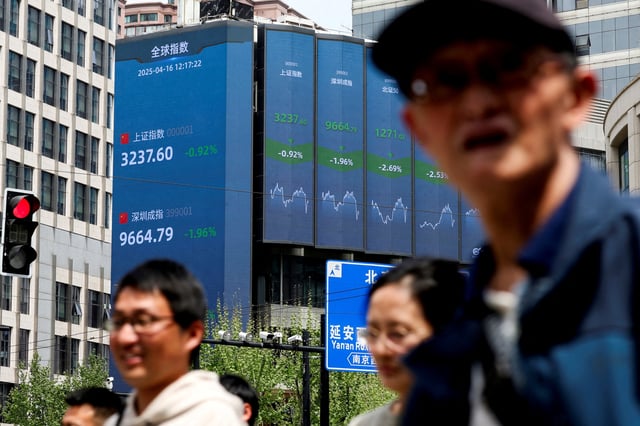

- The Shanghai Composite has risen roughly 25% since April to 10-year highs, with daily turnover topping 2 trillion yuan for 11 consecutive sessions, a record streak.

- Sovereign vehicles, insurers, mutual funds and ETFs have driven the advance, helped by regulatory nudges and relatively low valuations versus bonds.

- Households hold about 160 trillion yuan in savings and are starting to redeploy cash, with July showing a 1.1 trillion yuan drop in individual deposits and a 2.1 trillion yuan jump at non-bank financial institutions.

- Retail participation is returning gradually, with 1.9 million new accounts opened in July versus peaks of about 7 million per month in 2015, and broker estimates point to 1.8–2.1 trillion yuan of potential retail inflows.

- Leverage has climbed to multi-year highs near 2.1–2.18 trillion yuan in margin financing, yet accounts for only about 2.2% of floating market cap—roughly half 2015 levels—while analysts warn policy support risks stoking a bubble even as growth slows.