Overview

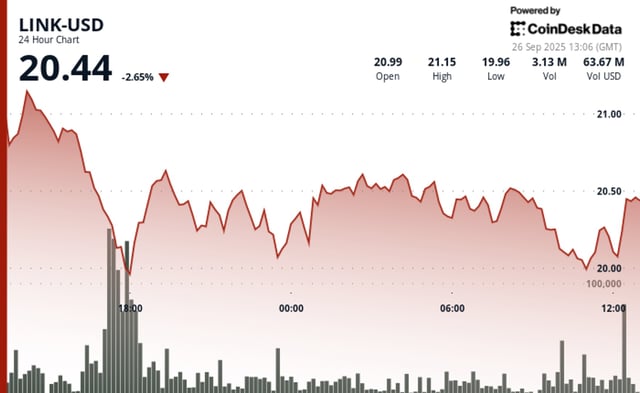

- LINK is down roughly 16–17% on the week and is trading near $21–$22 after brief dips below $20, with daily volume around $839 million.

- The $22 mark is the immediate pivot, with $21.30–$21.40 as key support; a rejection risks a move toward $20 and potentially about $18.70, while a daily close above ~$22.0–$22.2 could open $26.

- On-chain trackers reported two whale sales totaling about $8.17 million and rising exchange inflows, adding to downside pressure.

- A long-term diagonal resistance dating to 2021 continues to cap rallies, and analysts say a decisive break could revive a path toward $31.

- Some analysts highlight a multi-year triangle pattern; Ali Martinez views ~$16 as a potential buy zone and estimates a breakout target near $100 if the structure resolves higher.