Overview

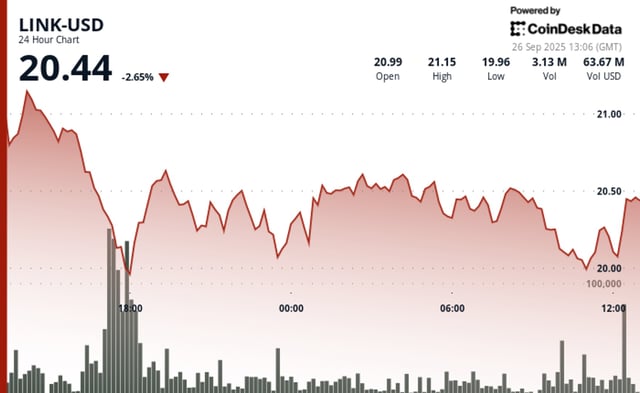

- LINK briefly slipped below $20 to a six‑week low before rebounding to about $20.3 on Friday, leaving the token down roughly 28% from August highs.

- On‑chain data flagged two large disposals totaling about $8.17 million in LINK, reinforcing near‑term selling pressure reported this week.

- Countering the outflows, Caliber disclosed a new ~$4 million purchase and the Chainlink Reserve bought roughly 47,903 LINK (≈$1 million), removing supply from the market.

- Traders are focused on $21.30–$21.40 and $20 as immediate supports with $22 as the near‑term pivot, where a close above could open a path toward ~$26.

- Technical voices highlight a long‑standing 2021 diagonal resistance and a multi‑year triangle, with projections ranging from a pullback toward ~$16 as a buy zone to upside targets at $31 and, in some analyst scenarios, toward ~$100; reported turnover climbed to about $1.19 billion.