Overview

- The on-chain Chainlink Reserve went live August 7 on Ethereum, converting revenue from enterprise contracts and on-chain usage fees into LINK and locking over $1 million with no withdrawals planned for years.

- Chainlink uses its Payment Abstraction infrastructure to accept payments in ETH, USDC or fiat and programmatically swap them into LINK for the reserve.

- Enterprise partners including Mastercard and JPMorgan now direct licensing and service fees into the LINK Reserve, tying major corporate adoption directly to token demand.

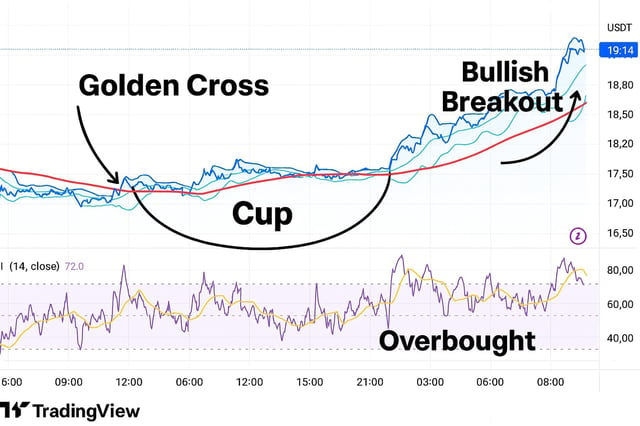

- Since the reserve’s launch, LINK’s price has surged more than 13% to trade above $19, outperforming most top-20 cryptocurrencies.

- Whale wallets holding 100,000 to 1,000,000 LINK increased by 4.2% in August, adding 0.67% of the supply as large-scale investors signal confidence.