Overview

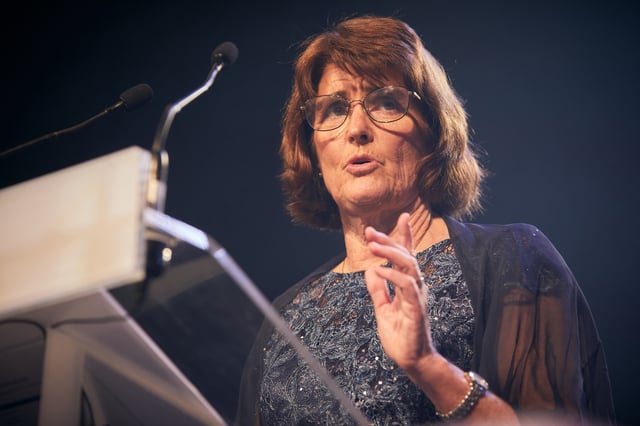

- RBA Governor Michele Bullock emphasized it is too early to determine the future path of interest rates due to the ongoing unpredictability of U.S. trade policies.

- Bullock warned of an inevitable period of economic and financial market volatility but reaffirmed Australia's financial system is well-positioned to handle external shocks.

- Market expectations for significant RBA rate cuts in May have softened following President Trump's decision to pause further tariff hikes, though uncertainty remains.

- Austan Goolsbee, President of the Federal Reserve Bank of Chicago, highlighted the absence of a clear playbook for responding to the economic shocks caused by U.S. tariffs.

- Goolsbee projected that U.S. interest rates could decline within 12 to 18 months, contingent on inflation moderation and economic stabilization.