Overview

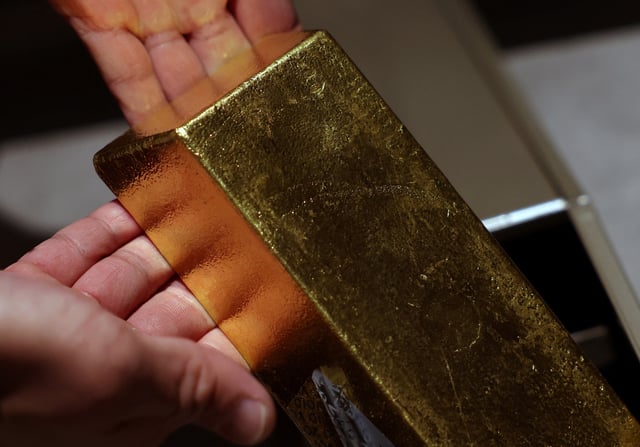

- 95% of central bank reserve managers expect to raise gold holdings over the next 12 months, up from 81% last year.

- 76% of respondents project gold will account for a larger share of reserves in five years, while nearly three-quarters foresee lower dollar-denominated assets.

- Central banks have purchased more than 1,000 metric tons of gold annually over the past three years in light of record price levels.

- Emerging market and developing economies are leading gold purchases, with 69% planning to boost reserves compared with 40% of advanced economy peers.

- 59% of central banks now store gold domestically, and the same share cites potential trade conflicts and tariffs as relevant to reserve management.