Overview

- An independent Wakely review of 22 states reduced Centene’s full-year net risk adjustment revenue estimate by about $1.8 billion, translating into roughly a $2.75 hit to adjusted diluted EPS.

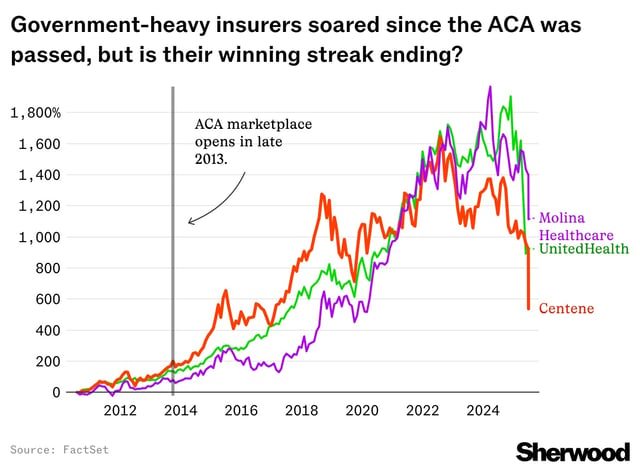

- Centene’s shares plunged 23% in after-hours trading on July 1, dragging down fellow government-plan insurers such as Oscar Health and Molina Healthcare with steep stock declines.

- The U.S. Senate passed a budget bill projected to strip ACA and Medicaid coverage from 11 million Americans, threatening the primary revenue streams for insurers like Centene.

- In the first quarter, Centene’s ACA marketplace enrollment rose 29% year over year to 5.6 million members, offset by a decline of over 330,000 Medicaid enrollees.

- Centene said it expects similar morbidity trends in the seven states not yet reviewed by Wakely, which could trigger additional reductions in its risk adjustment transfers.