Overview

- Centene officially rescinded its full-year 2025 earnings guidance after Wakely data covering 22 ACA marketplace states revealed weaker enrollment growth and elevated morbidity.

- The insurer disclosed an expected $1.8 billion reduction in net risk adjustment transfers, translating into a $2.75 per-share hit to adjusted earnings.

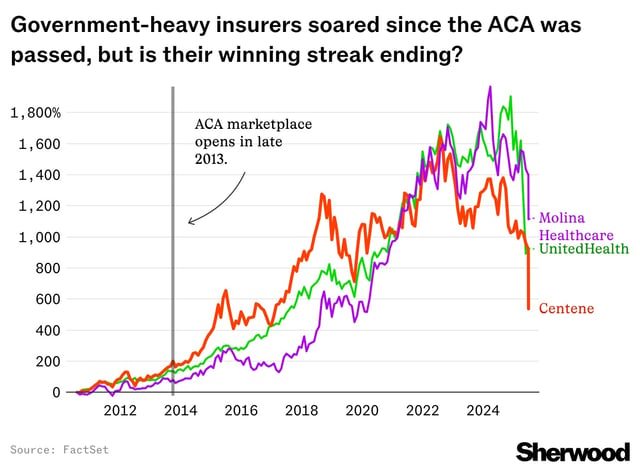

- Shares plunged roughly 40%, closing at an eight-year low as investors absorbed the implications of the revised outlook.

- Centene has begun refiling its 2026 marketplace rates to reflect a higher projected baseline morbidity and anticipates elevated Medicaid health benefit ratios in Q2.

- Management will provide a fuller update on its revised guidance and second-quarter financial results at the July 25 earnings release.