Overview

- Despite the Federal Reserve's rate hikes, high-yield savings accounts and certificates of deposit (CDs) are offering attractive rates, with some CDs offering up to 5.66% APY.

- Short-term CDs are currently offering higher rates than long-term CDs due to the inverted yield curve, a phenomenon that suggests investors predict lower interest rates in the future.

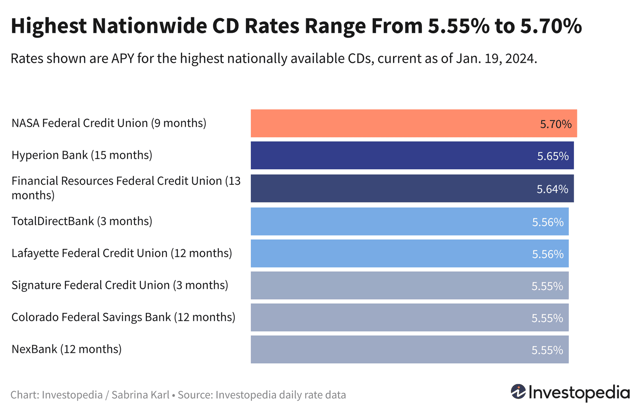

- The best nationwide CD rate today is still 5.70% APY from NASA Federal Credit Union on a 9-month term, followed by 5.65% from Hyperion Bank for a 15-month offer.

- Financial advisors recommend considering investment horizon and liquidity needs when choosing between a short or long-term CD.

- The Federal Reserve may begin lowering interest rates sometime in 2024, which could make it a smart time to lock in one of today's best CD rates.