Overview

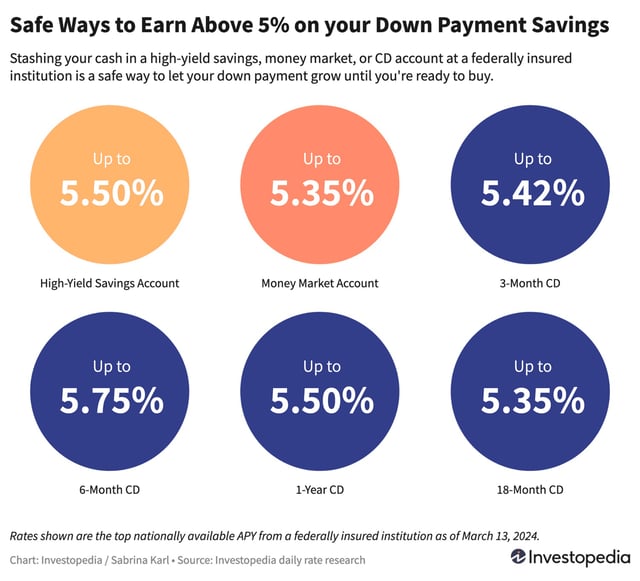

- CD rates have reached historic highs, with APYs exceeding 5% on shorter terms, offering a low-risk investment opportunity.

- The Federal Reserve's recent decision to maintain the federal target interest rate suggests potential rate cuts in 2024, making the current rates particularly attractive.

- Digital banks and online accounts continue to lead with the highest CD rates, significantly outpacing the national average.

- Experts advise that now is a prime time to secure CD rates before anticipated cuts, with consumer prices for fuel, housing, and food on the rise.

- High-yield savings accounts and money market accounts also offer competitive rates, providing alternatives for those seeking flexibility.