Overview

- The CBO estimates that maintaining higher import tariffs would reduce total deficits by about $4 trillion over the next decade, including $3.3 trillion in smaller primary deficits and $0.7 trillion in lower interest costs.

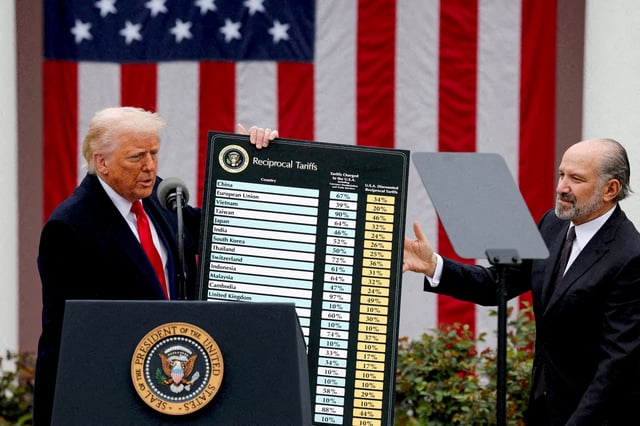

- The update reflects a sharp run-up in trade taxes, with the effective tariff rate rising roughly 18 percentage points from a year ago, according to the CBO.

- CBO Director Phillip Swagel says customs duties are on track to total about $200 billion this fiscal year if rates do not change.

- Outside indicators show elevated tariff exposure, with Oxford Economics putting average rates at 16.7% in August from 15.1% in June and CBP reporting more than $26 billion in duties assessed so far this year.

- CBO notes the revenue could help offset the Republicans’ One Big Beautiful Bill, which it estimates would widen deficits by $3.4 trillion over ten years, though the tariff outlook remains subject to negotiations and legal challenges.