Overview

- CBO projects a $3.3 trillion reduction in primary deficits plus $700 billion in lower interest costs over 10 years, with about $200 billion in customs receipts expected this fiscal year if current rates hold.

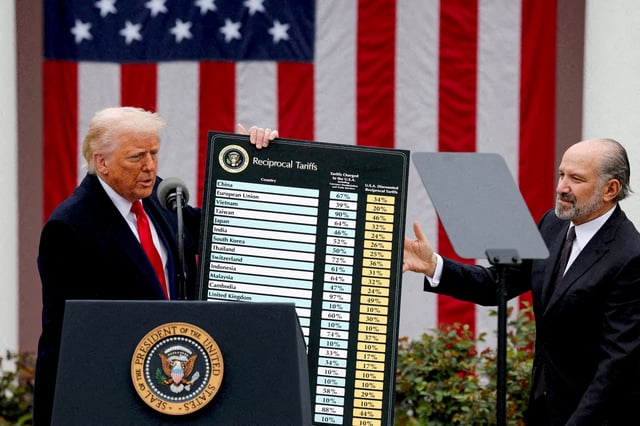

- The White House highlighted the projection as validation of its trade strategy, arguing tariff revenue helps offset the $3.4 trillion deficit increase tied to this year’s tax-and-spending package.

- Economists report pass-through to consumers, with Mark Zandi saying prices are rising and PIMCO noting households will bear part of the cost, which could slow consumption in a consumer-driven economy.

- Policy uncertainty is restraining capital spending, and analysis from Yale’s Budget Lab estimates the 2025 tariff regime could leave the long-run level of real GDP about 0.4% lower.

- Small, import-dependent firms report cash-flow strains and critics describe the levies as a regressive tax, while legal challenges and potential non-tariff retaliation by trading partners add further risk.