Overview

- The Income-tax Act, 2025 has been enacted and notified, with implementation scheduled from April 1, 2026.

- A rules-and-forms committee set up on February 13 has drafted simplified rules and redesigned forms now under TPL scrutiny before finance and law approvals and parliamentary laying.

- The department is upgrading IT systems, training officers and planning smarter, more prefilled return formats, with refunds unaffected and FY27 filings under the 1961 law before new ITRs start from FY28.

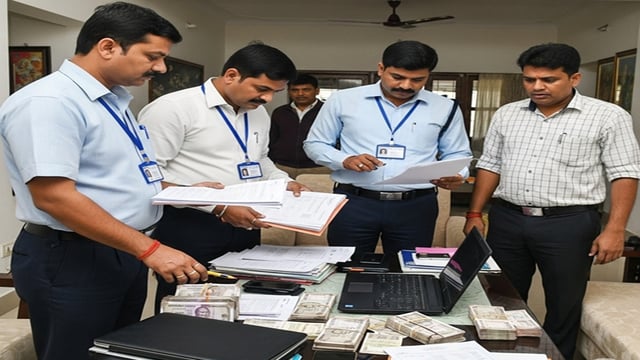

- The statute explicitly covers access to virtual digital spaces for search, seizure and survey, with SOPs for digital-asset handling expected and officials emphasizing privacy protections and limited use.

- Structural changes streamline the code to 536 sections across 23 chapters and introduce a single tax year concept, with supplementary FAQs and an old-to-new provision mapping to aid transition.