Overview

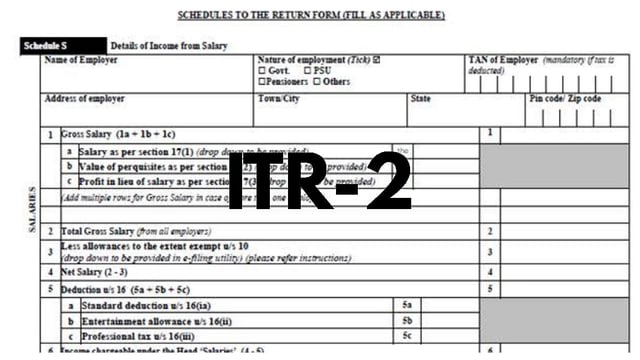

- The Income Tax Department has released the updated ITR-2 form, effective April 1, 2025, making it mandatory for salaried employees and pensioners with multiple income sources and investments.

- ITR-2 requires disclosures for foreign assets, digital assets, and legal entity identifiers for high-value transactions, with stricter reporting norms introduced under new schedules.

- The asset and liability disclosure threshold for ITR-2 has been raised from ₹50 lakh to ₹1 crore, easing compliance for middle-income taxpayers.

- ITR-4 (Sugam) has been expanded to include taxpayers with long-term capital gains up to ₹1.25 lakh, broadening its applicability under the presumptive taxation scheme.

- The updated forms integrate digital compliance features and align with the revised tax regime, streamlining the filing process for small and middle-income taxpayers.