Overview

- The Income-tax Act, 2025 has been passed, received presidential assent, and will replace the 1961 law from April 1, 2026, with plainer language and a leaner structure that cuts sections and adds tables and formulae.

- CBDT says draft rules, redesigned forms, SOPs, guidance notes and supplementary FAQs are in the works, with a target to finalize and notify them by December, alongside IT system upgrades and officer training.

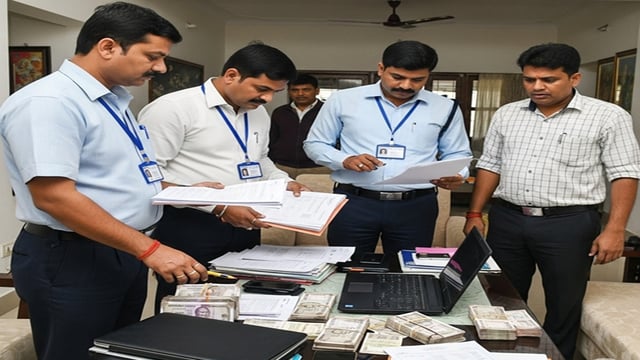

- The statute explicitly covers “virtual digital space,” allowing access during search and seizure to emails, social media, net-banking, trading accounts, cloud servers and crypto wallets, including password override when needed.

- Officials emphasize these digital search powers are not an expansion, will be used sparingly in searches and surveys, and remain subject to confidentiality provisions and accountability under the Act.

- Redesigned tax forms, including ITR and TDS/TCS statements, will align with the new “tax year” terminology and aim to be simpler and more prefilled, with detailed SOPs expected to set safeguards for handling seized digital data.