Overview

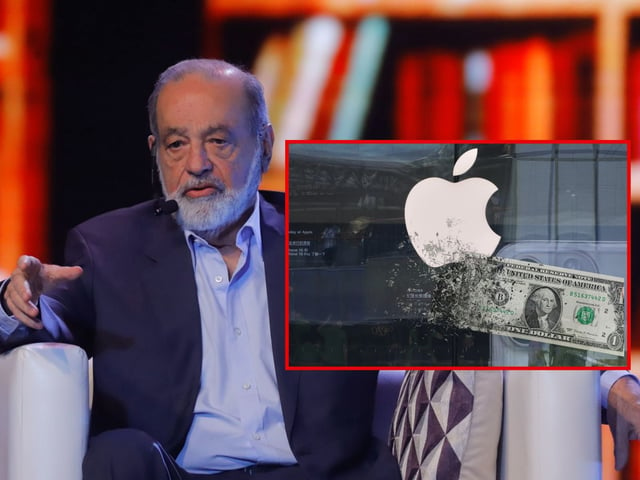

- Slim said his largest error as an investor was selling Apple shares in 1997 before Steve Jobs’ comeback, noting he bought around $17 and sold near $100, missing the long rally.

- He added that passing on Amazon during its 2008–2009 swoon was another missed opportunity he now counts as a mistake.

- Calling Tesla’s price “irrational,” he estimated the stock trades at roughly 150 to 200 times earnings and said he has strong interest in a short position.

- He reiterated core principles including the “do half” rule to manage uncertainty, broad diversification, maintaining cash to deploy in crises and avoiding borrowed money or leverage.

- Reflecting on strategy, he credited Telcel’s prepaid “Plan Gillette” model with mass adoption in Mexico, where about 83% of mobile lines are prepaid and Telcel holds roughly 82–85 million lines.