Overview

- Insurance Commissioner Ricardo Lara launched a market conduct examination on June 12 to determine whether State Farm violated California’s consumer protection and claims‐handling rules.

- The inquiry will scrutinize troubling patterns such as frequent adjuster reassignments, inconsistent treatment of similar claims, and inadequate recordkeeping identified in complaints.

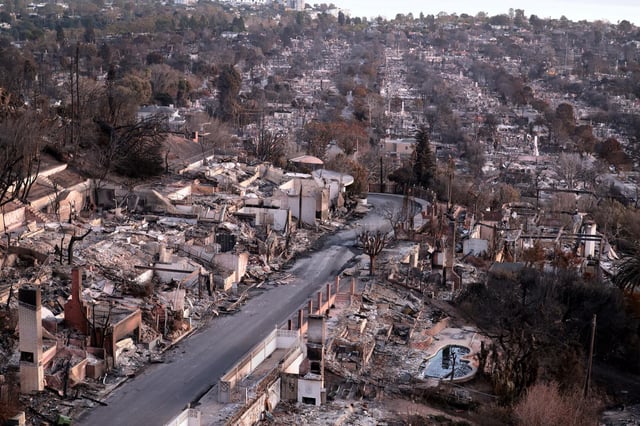

- State Farm has received over 12,800 wildfire claims and paid more than $3.85 billion as of early June, estimating $7.6 billion in total fire-related costs before reinsurance reduces its net losses to about $612 million.

- On June 1, Lara approved a 17 percent emergency rate hike for State Farm customers following the insurer’s request to shore up capital after the costly wildfires.

- The Department of Insurance is urging survivors to file formal complaints to support a review that could last several months and lead to reforms or increased payouts if violations are uncovered.