Overview

- About four in five of the plan’s more than 550,000 homeowner policies would see increases and roughly 97,000 would get cuts, with changes taking effect April 1, 2026 if approved.

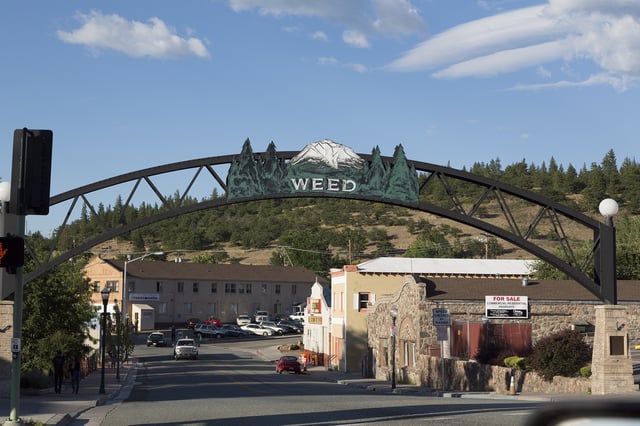

- Proposed adjustments vary widely by location, with high-risk areas such as the Sierra Nevada and Sonoma County facing larger hikes and Clayton’s 94517 ZIP projected to rise by more than 69% on average.

- The FAIR Plan cites nearly $4 billion in estimated losses from January wildfires and a separate $1 billion assessment on member insurers to fund claims as key drivers of the request.

- The California Department of Insurance says it will apply a data-driven review, and Insurance Commissioner Ricardo Lara has final authority on the outcome.

- The program remains under scrutiny over smoke-damage claims after a June Superior Court ruling found its policy unlawful, even as it offers mitigation discounts of up to 15% and continues to provide fire-only coverage often paired with a separate DIC policy.