Overview

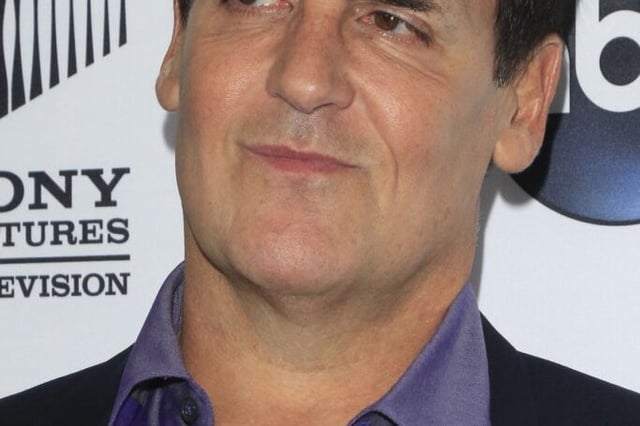

- They’re borrowing or tapping cash reserves to buy three to six months of inventory ahead of potential tariff hikes, says Mark Cuban.

- This front-loading approach carries steep costs, including lost interest or loan rates of 10%–20%, which strain corporate balance sheets.

- Companies from startups to giants like Amazon and Home Depot are freezing prices or offering discounts to clear excess stock and shore up liquidity.

- The personal consumption expenditures index rose just 0.2% in April and Treasury Secretary Scott Bessent reports no broad price increases, though Goldman Sachs forecasts inflation climbing to 3.6% by year-end.

- Retailers such as Walmart have signaled impending price hikes, suggesting tariff-driven cost pressures may soon filter through to consumers.