Overview

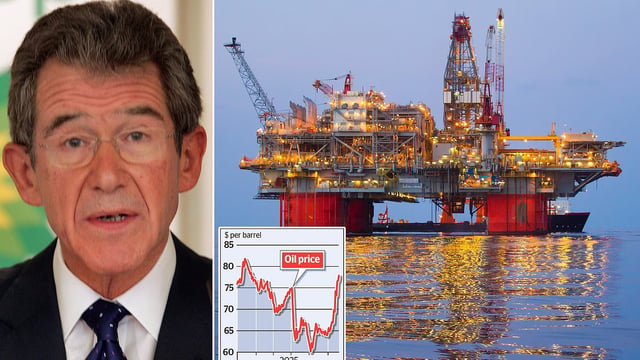

- Continued missile exchanges between Israel and Iran have escalated geopolitical tensions and driven Brent crude to its highest level in five months near $80 per barrel.

- Citibank analysts project Brent will trade between $75 and $78 per barrel if 1.1 million barrels per day of Iranian exports are disrupted and could climb to $90 if three million bpd is halted.

- JP Morgan warns that a closure of the Strait of Hormuz could send oil prices to $120–130 per barrel and Barclays cautions they may exceed $100 in a wider regional conflict.

- Iran’s output of about 3.3 million barrels per day makes it OPEC’s third-largest producer, although increased OPEC production and higher global output could offset supply shocks.

- President Trump is weighing potential US military intervention in the Israel-Iran conflict and expects to announce his decision within two weeks, adding uncertainty to market forecasts.