Overview

- From October 13, recurring interbank debits to corporate or non‑authorized recipients must use Pix Automático, with institutions given until January 1, 2026 to adapt existing agreements.

- Banco Central expanded enforcement by excluding Pix participants with net equity below R$5 million and extending the reentry ban for expelled firms to 60 months.

- Rules now allow risk-based Pix limits distinct from TED, broaden cautelar blocking to legal entities, and require institutions to restrict transfers and key actions for clients flagged for transactional fraud.

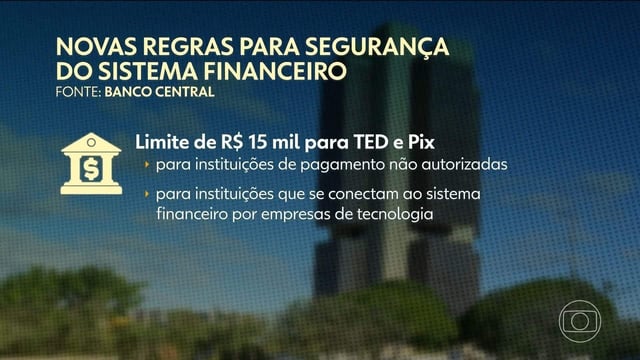

- A previously announced cap of R$15,000 per Pix or TED applies to non‑authorized payment institutions and entities connected via PSTIs, which also face tougher accreditation including a R$15 million capital floor and stronger governance controls.

- The official rollout of Pix Parcelado is delayed by roughly up to three months, with regulation expected in October and user‑experience guidance in December, as experts emphasize the BC’s core Pix infrastructure was not breached.