Overview

- CMN and the central bank approved rules requiring Pix Automático for recurring debits between different institutions when the payee is a company or a non‑authorized entity, taking effect on October 13, 2025 with an adaptation period until January 1, 2026.

- Interbank recurring charges must use Pix Automático with standardized consent in the payer’s app, while same‑bank debits continue under the traditional automatic debit model.

- The central bank issued a stricter Pix penalties manual that increases fines and scales sanctions by institution size and the gravity of violations.

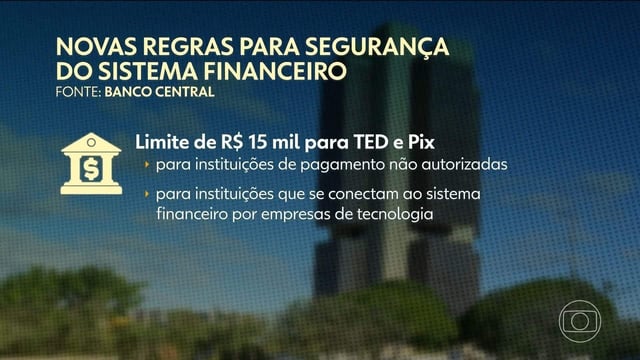

- New prudential thresholds include exclusion of participants that lack at least R$5 million in equity, a R$15 million minimum capital for PSTIs with up to four months to comply, and a 60‑month wait to reapply after exclusion.

- The official rollout of Pix Parcelado was postponed by roughly up to three months, with regulations now expected in October and user‑experience guidance in December, as security work continues alongside earlier measures such as the R$15,000 cap for certain IP transactions.