Overview

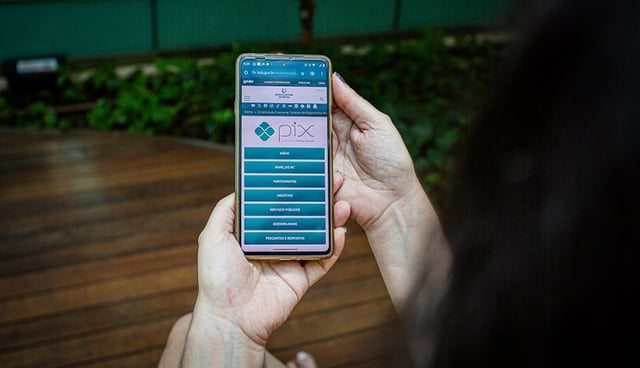

- CMN and the Central Bank approved a rule requiring Pix Automático when the payee is a legal entity or an institution not authorized by the monetary authority.

- The rule takes effect on October 13, 2025, and institutions have until January 1, 2026 to adapt contracts and systems.

- Pix Automático is integrated with Open Finance to standardize payer authorization for recurring debits and broaden corporate use, and institutions have been required to offer it since June.

- Separately, CMN set uniform accounting for sustainability‑related assets and liabilities at financial institutions starting in January 2027.

- The Central Bank postponed the Pix Parcelado regulation—now expected in October with a user‑experience manual in December—and is tightening security with stricter oversight of tech intermediaries, a R$15,000 per‑transaction cap, and mandatory rejection of transactions flagged with consistent fraud indicators.