Overview

- CMN and the Central Bank approved a rule requiring Pix Automático for debit operations when the payee is a legal entity or an institution not authorized by the BC, effective October 13 with adaptation allowed until January 1, 2026.

- The Central Bank has postponed the formal rollout of Pix Parcelado to refine the regulation and prioritize safeguards, with publication of manuals now expected between October and December and the launch potentially slipping by up to three months, according to outlets that cited internal discussions.

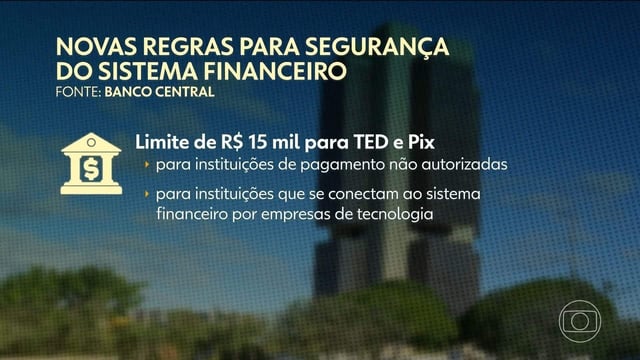

- Earlier this month the BC tightened controls across the Pix ecosystem, including a R$15,000 cap per TED or Pix for non‑authorized IPs and those connecting via PSTIs, tougher governance and a R$15 million capital floor for PSTIs, risk‑based transaction limits, and stricter sanctions for noncompliant participants.

- Cybersecurity specialists say the core Pix infrastructure was not breached, with recent incidents traced to vulnerabilities at participating institutions and their technology providers, highlighting uneven security maturity.

- Fintech groups voiced support for stronger oversight while warning against blanket stigmatization, as authorities also step up data reporting to the tax authority and debate structural changes such as concentrating custody and using Open Finance models to separate custody from transaction initiation.