Overview

- BP's stock rose over 6% after reports that Elliott Management has acquired a significant stake in the company, though the size of the stake remains undisclosed.

- Elliott Management, known for pushing major corporate changes, is reportedly advocating for transformative measures to enhance BP's shareholder value.

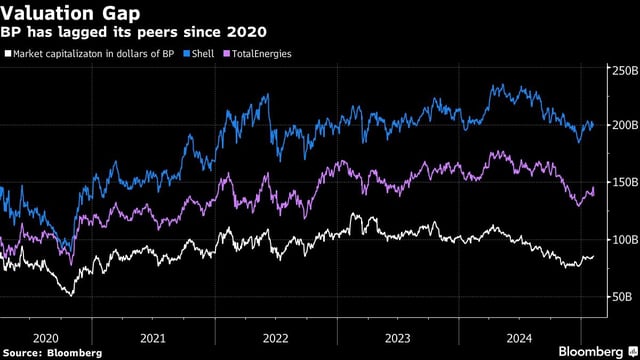

- BP has faced criticism for lagging behind competitors like Shell and Exxon Mobil, with its shares dropping 9% over the past year compared to gains by rivals.

- CEO Murray Auchincloss, who took over after Bernard Looney's abrupt departure, is expected to outline a revised strategy on February 26, signaling a shift back toward oil and gas investments.

- The company has announced cost-cutting measures, including a $2 billion savings target by 2026 and significant workforce reductions, alongside a retreat from some renewable energy projects.