Overview

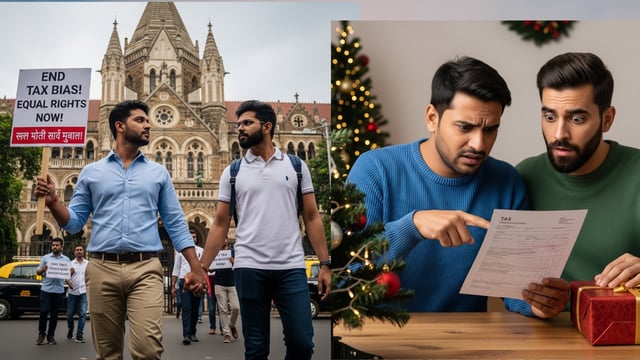

- Payio Ashiho and Vivek Divan petitioned the Bombay High Court to interpret 'spouse' in the fifth proviso of Section 56(2)(x) as including long-term same-sex partners

- Under current law, gifts over Rs 50,000 received without consideration are taxed as income unless given by a ‘spouse’ or certain relatives, a definition that excludes same-sex partners

- A bench of Justices B.P. Colabawalla and Firdosh Pooniwalla admitted the plea and issued notices to the Attorney General of India and the Income Tax Department

- The September 18 hearing will focus on the constitutional validity of restricting the gift-tax exemption to legally recognized spouses

- Experts say a favorable ruling could extend fiscal protections to same-sex couples and shape broader LGBTQIA+ economic rights in India