Overview

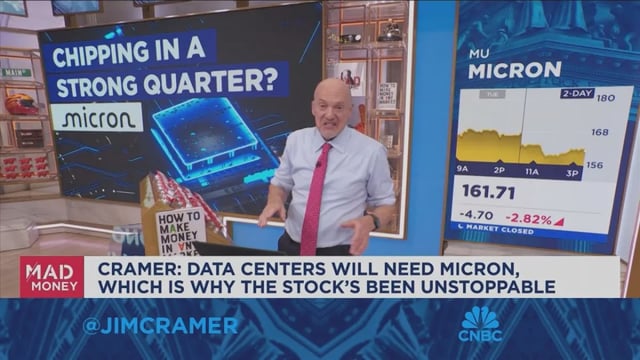

- Micron posted Q4 FY2025 revenue of $11.32 billion with diluted EPS of $2.83 and a 44.7% gross margin.

- Guidance for Q1 FY2026 calls for $12.5 billion in revenue at about 50.5% gross margin and EPS of roughly $3.56.

- Bank of America’s Vivek Arya raised the price target to $180 while maintaining a neutral rating.

- Shares traded about 4% lower near $159 despite the beat and upbeat outlook.

- Management highlighted AI-driven demand for HBM and high-capacity SSDs, while analysts flagged risks from potential ASP declines, Chinese competition, share shifts, and end‑market softness.