Overview

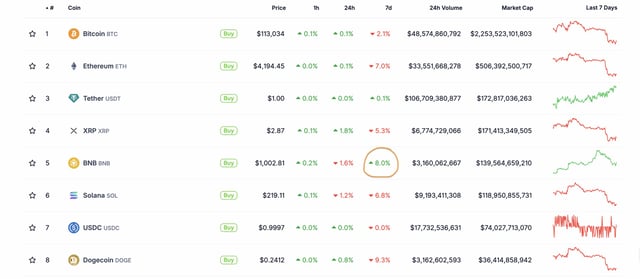

- BNB is trading near $1,012 and remains close to its all‑time high around $1,079 after recovering from a dip to roughly $975.

- Charts show mixed signals, with bullish momentum offset by a bearish RSI divergence and an evening‑star pattern that raise pullback risks.

- Analysts outline a break above recent highs potentially targeting about $1,229, while supports include the 20‑day EMA near $947, the 50‑day around $882, and the 200‑day near $747, with a liquidity zone around $900–$945.

- Derivatives positioning shows a bullish tilt, including a positive funding rate near 0.0062% and record BNB futures open interest around $2.4 billion.

- Flows remain a key driver, with CEA Industries’ treasury arm confirming a $160 million August purchase, a proposed BNB Chain fee cut and faster blocks under consideration, and rising on‑chain activity attributed in part to the Aster perps DEX.