Overview

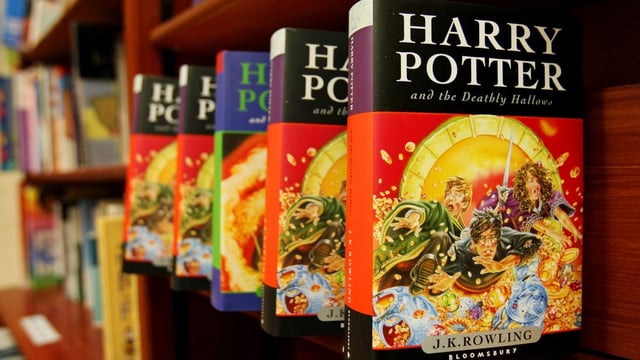

- Bloomsbury Publishing's pre-tax profit fell by 22% to £32.5 million for the year ending February 28, 2025, despite a 5% rise in revenue to £361 million.

- Shares in the company dropped by approximately 15% following the profit announcement, reflecting investor concerns over the decline.

- Non-consumer sales grew by 12% to £105 million, driven by the £63 million acquisition of US academic publisher Rowman & Littlefield, which contributed £19.8 million in revenue.

- The board recommended a 5% increase in the annual dividend, bringing the full-year payout to 15.43p per share, as part of efforts to enhance shareholder returns.

- Bloomsbury is exploring responsible AI licensing opportunities for its academic content and expects trading for 2025/26 to align with consensus expectations.