Overview

- Bitcoin fell to roughly $108,700–$109,000 before hovering near $110,000, marking its weakest levels in almost seven weeks.

- Roughly $800 million to $940 million in crypto futures were liquidated over 24 hours, with the majority coming from long positions.

- On-chain trackers tied a key trigger to a whale offloading about 24,000 BTC on Aug. 25, which helped accelerate the sell-off.

- Spot ETF flows diverged as Ethereum funds took in about $444 million and Bitcoin funds recorded roughly $219 million of net inflows after six straight days of BTC outflows near $1.2 billion.

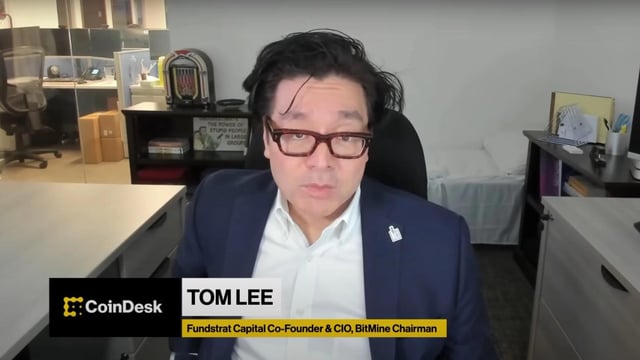

- Derivatives metrics show positive funding and elevated open interest, leaving markets vulnerable to further long squeezes even as institutions add to ETH positions, including Bitmine’s purchase of 4,871 ETH.