Overview

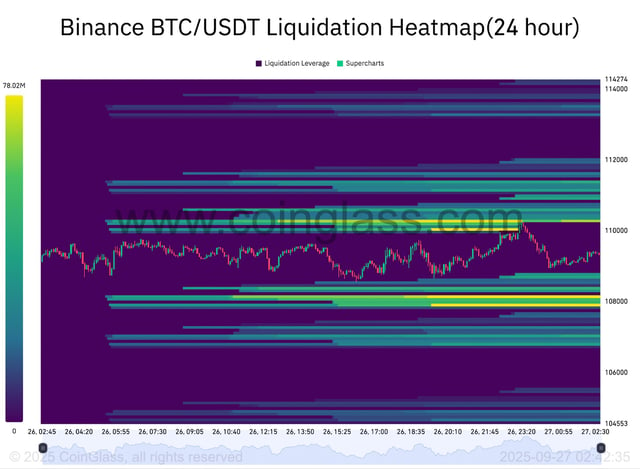

- Bitcoin traded around $109,000–$110,000 Friday after dipping under $109,000, while Ethereum briefly fell below $4,000 before rebounding above that level.

- CoinGlass-tracked wipeouts reached roughly $1.0–$1.1 billion over the latest session, with more than 200,000 traders liquidated and risk appetite sliding.

- SoSoValue data shows spot bitcoin ETFs recorded $725 million in net outflows since Monday, including $258.4 million Thursday, with BlackRock’s IBIT the lone fund taking in new money.

- Sentiment turned cautious as the Fear & Greed Index fell to 28 and RSI readings eased, even as PCE inflation arrived in line with forecasts and prompted a modest market bounce.

- Analysts flagged a compressed range near $108k–$113k and key supports at $107k and $102k, with several chartists watching the broader $107k–$98k band and upcoming options expiries and early-October macro data for direction.