Overview

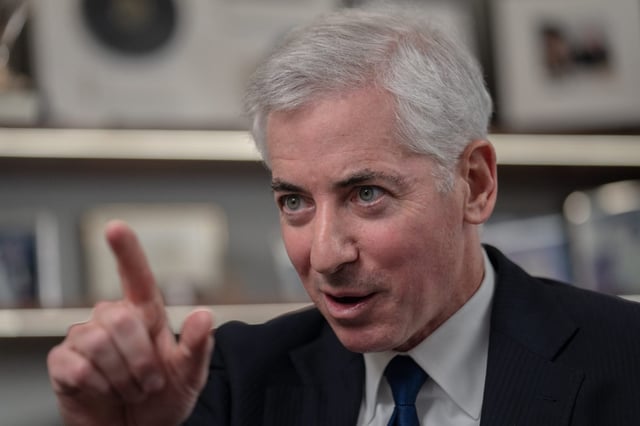

- Bill Ackman's Pershing Square has offered $900 million to acquire 10 million newly issued shares of Howard Hughes Holdings at $90 per share, a 12% premium to its recent closing price.

- The proposal would increase Pershing Square's stake in the company from 37.6% to 48%, positioning Ackman as chairman and CEO of Howard Hughes Holdings.

- Ackman plans to use Howard Hughes as a platform to build a diversified financial conglomerate, drawing inspiration from Warren Buffett's transformation of Berkshire Hathaway.

- The deal would allow Howard Hughes Holdings to pursue controlling interests in public and private companies while continuing its focus on large-scale, master-planned communities.

- A special committee of independent directors at Howard Hughes Holdings is evaluating the offer, which represents a significant personal financial commitment from Ackman.