Overview

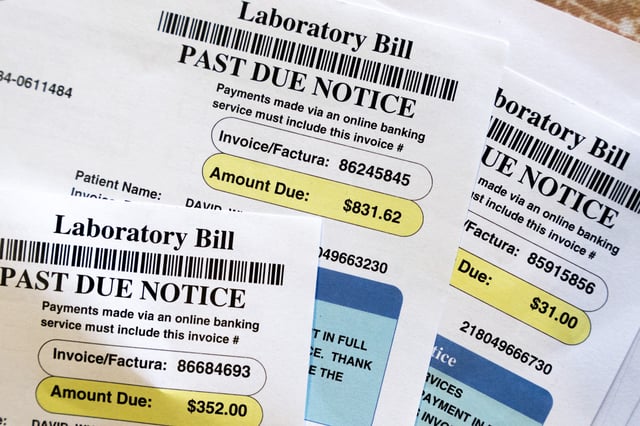

- The Consumer Financial Protection Bureau's proposed rules would eliminate medical debt from credit reports, including dental bills.

- Vice President Kamala Harris emphasized the unfair economic barriers medical debt creates for many Americans.

- The regulation could increase credit scores by an average of 20 points for 15 million people, enabling more access to loans and mortgages.

- Critics argue the rule does not address the underlying issue of affordable healthcare access.

- Public comments on the proposal are being accepted until August 12, with a final rule expected early next year.