Overview

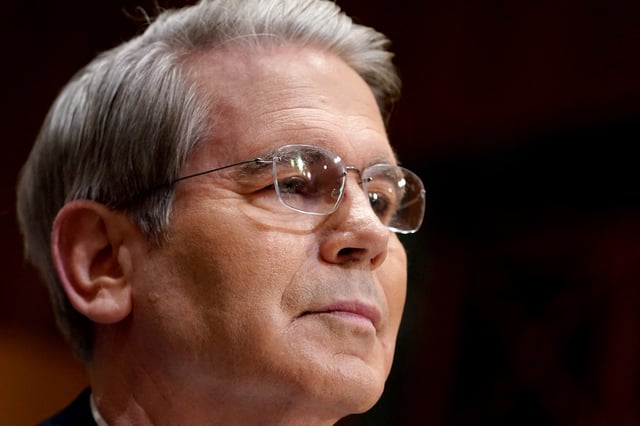

- Treasury Secretary Scott Bessent told Bloomberg that the Bank of Japan is “behind the curve” on tightening and confirmed he had discussed the issue directly with Governor Kazuo Ueda.

- He warned that overseas developments in Japan and Germany are driving up U.S. Treasury yields, signaling the impact of divergent policies on American borrowing costs.

- Bessent called for the Federal Reserve to cut its policy rate by at least 1.5 percent, including a 50-basis-point reduction in September to support the U.S. economy.

- Markets reacted with USD/JPY sliding to around 146.40 as investors weighed the significance of a senior U.S. official’s direct critique of foreign policy.

- Analysts caution that breaking communication norms could complicate the BOJ’s decision-making and add uncertainty to currency and bond markets.