Overview

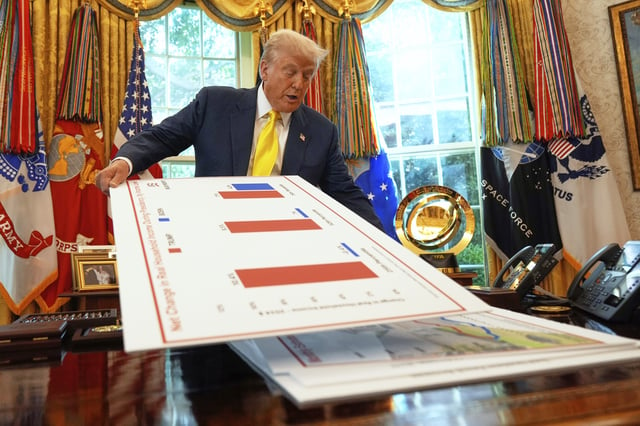

- The second estimate raised annualized Q2 GDP to 3.3% from 3.0% as consumer spending was revised up to 1.6% and business investment strengthened, notably in equipment and intellectual property.

- Imports fell 29.8% after earlier front‑loading before tariffs, and with exports down 1.3%, net trade added nearly five percentage points to the quarter’s growth.

- A gauge of underlying demand, final sales to private domestic purchasers, rose 1.9%, while gross domestic income jumped 4.8% and the GDP–GDI average rebounded at a 4.0% pace.

- Corporate profits increased by $65.5 billion in Q2, even as firms including Caterpillar, General Motors, and Abercrombie & Fitch flagged higher tariff costs affecting earnings.

- PCE inflation held near target at 2.0% with core at 2.5%; investors see high odds of a September Fed rate cut, and the Commerce Department’s final Q2 estimate with annual revisions arrives Sept. 25.