Overview

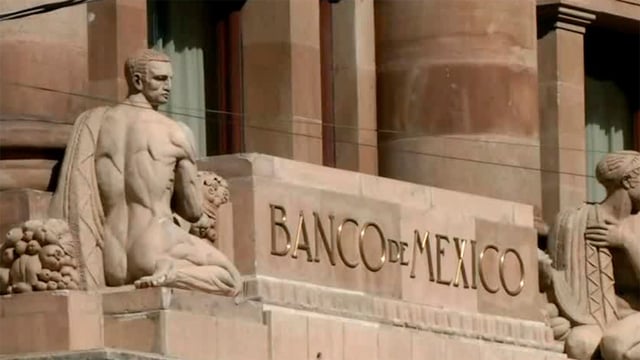

- The October minutes say the board will consider additional reductions to the reference rate and keep decisions aligned with the path needed to return inflation to 3%.

- At the September 25 meeting Banxico cut the policy rate by 25 basis points to 7.5%, marking a tenth straight reduction and bringing cumulative easing to 375 basis points from the 11.25% peak.

- Three of five board members favored guiding continued cuts with graduality, one urged a meeting‑by‑meeting approach, and one argued policy should stay restrictive until core inflation clearly weakens.

- Subgovernor Jonathan Heath dissented, warning that unusually low non‑core inflation projections and planned 2026 tax hikes and new tariffs on imports, including inputs from China, pose non‑trivial upside risks.

- Banamex expects two more 25‑basis‑point cuts in November and December to 7.0% by year‑end, while other analysts foresee cautious, data‑dependent easing as the Fed’s recent 25‑point cut and Mexico’s 3.76% September inflation—alongside a 4.28% core reading—shape the outlook.