Overview

- The Bank of England has reduced interest rates to 4.5% and is expected to continue gradual cuts, though the pace may vary based on evolving economic conditions.

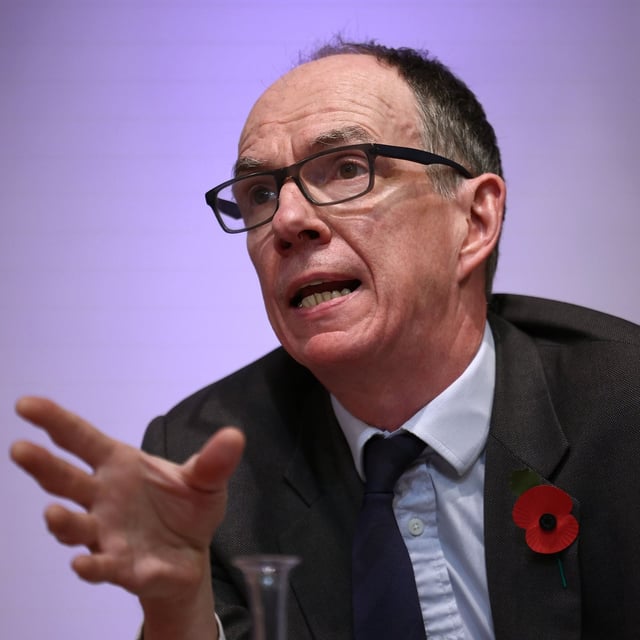

- Deputy Governor Dave Ramsden emphasized the need for caution in monetary easing, comparing it to a careful descent down a mountain, while leaving room for faster adjustments if needed.

- Rising inflation risks, with projections reaching 3.7% later this year, and higher-than-expected wage growth are complicating the Bank’s efforts to meet its 2% inflation target.

- Uncertainty in the labor market, including potential impacts from increased employer national insurance contributions, is a key concern for policymakers.

- Global trade tensions, including potential U.S. tariffs on UK goods, add further unpredictability to the economic outlook, influencing the Bank’s cautious stance.