Overview

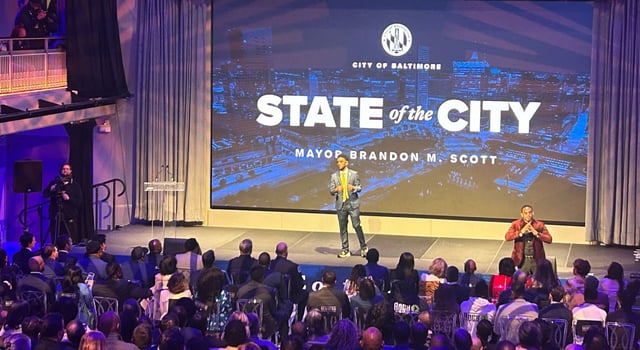

- Mayor Brandon Scott announced plans to lower Baltimore's residential property tax rate from $2.248 to under $2 per $100 assessed value by 2028, marking the city's first tax relief since 2020.

- The proposed tax reduction will be gradual and is paired with a $4.6 billion fiscal year 2026 budget aimed at closing an $85 million deficit through fee and fine adjustments.

- City budget officials project an $8 million deficit for the current fiscal year ending June 30, with potential income tax losses of $3–5 million due to federal workforce cuts.

- Baltimore's property tax revenues exceeded expectations in fiscal year 2024, generating a $16.3 million surplus, which helped balance that year's budget.

- The City Council must review and approve the proposed budget and tax plan, which the mayor asserts can be implemented without raising other city taxes.