Overview

- The Australian Labor government, with Greens support, will pass the superannuation tax reform, effective July 1, targeting earnings on balances exceeding A$3 million.

- The tax includes unrealised gains on assets within self-managed super funds, such as property, farms, and shares, prompting portfolio restructuring among affected retirees.

- Treasury estimates the tax will initially impact 80,000 accounts, representing the top 10% of taxpayers, and generate A$2.3 billion in revenue by 2027-28, with A$40 billion expected over a decade.

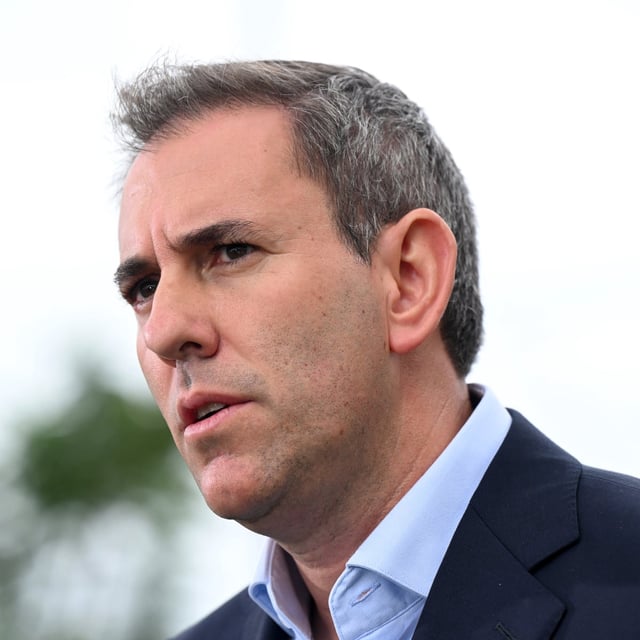

- The Greens sought to lower the threshold to A$2 million and index it to inflation, but Treasurer Jim Chalmers rejected these proposals, maintaining the A$3 million cap.

- Critics, including independent MP Allegra Spender and financial experts, warn the tax could discourage investment in high-growth businesses and lead to significant asset sell-offs.